Analysis Of Business Revenue Contributions

Break-Even Point (units) = Fixed Costs ÷ (Revenue Per Unit – Variable Cost Per Unit) To calculate break-even point based on sales in GBP: Divide your fixed costs by the contribution margin. The contribution margin is calculated by subtracting variable costs from the price of a product. This amount is then used to cover the fixed costs.

Analysis Of Business Revenue Contributions 2017

Charitable organizations play a vital role in society, and they generally work hard to solicit contributions from whatever sources they can find. Increasingly, though, donations have become only one element of how successful charities make money. In particular, many people don't realize that some entities that have extensive budgets and charge users for their services, including hospitals, educational institutions, and fitness centers, are organized as nonprofit organizations. Charities have to account for these different funding sources separately, and charities that make too much of their money from certain types of earned revenue can face questions about whether their nonprofit status is legitimate.

- Most business people readily accept positive financial outcomes as business benefits. These are easy to measure in terms such as cost savings, revenue growth, cash inflows, or increased profits. Many people, however, are uncertain about how to measure or value contributions to business objectives they define in non-financial terms.

- In financial accounting, revenue is the total amount of cash generated from the sale of goods or services from a company's usual operations. For a convenience store, this might include sales of a snack or a soft drink. Income, which is also written as net earnings or net profit, is the company's 'bottom line.'

Earned revenue vs. contributions

The difference between earned revenue and contributions is quite simple. Earned revenue is money that a charity earns for providing goods or services. For example, sales of tickets and admission fees are common items of earned revenue for museums and nonprofit performing arts organizations, while items like sales in a gift shop or thrift store also generate earned revenue.

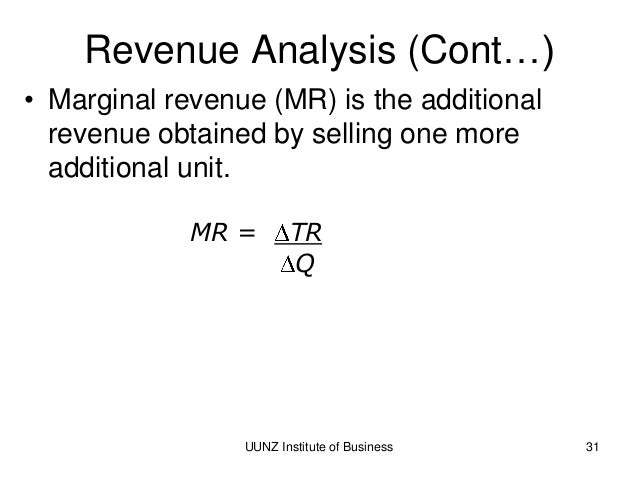

Revenue Analysis Definition

Contributions, on the other hand, are gifts made freely without receiving anything in exchange. Monetary contributions are most common, but many charities also accept gifts of items like clothing or food.

For the donor, the difference between contributions and earned revenue is that only contributions are eligible for a tax deduction. Payments for goods or services don't qualify because what you receive is equal in value to what you pay, taking away any charitable intent.

Controversy about charities and earned revenue

In some cases, charities have run into difficulty because of their attempts to generate earned revenue. For instance, you'll often see a charitable fitness center like the YMCA operating in the same community as a for-profit fitness center. The charity gets the benefit of tax-exempt status, which can save on operating costs as well as providing additional funding sources, and so for-profit businesses have argued that charitable status is inappropriate in some cases. An even bigger example is in the hospital world, where for-profit and tax-exempt entities compete for patients to serve and medical professionals to hire.

The tax law has no prohibition on earned revenue generally but rather focuses on whether that revenue is related to the nonprofit's charitable mission. If the charity regularly carries on a trade or business not substantially related to the organization's tax-exempt purpose, then the charity will have to pay unrelated business income tax on that income. In addition, if the charity earns too high a percentage of its overall revenue from unrelated business activity, it risks losing its tax-exempt status entirely.

Charities have become adept at using tactics from the business world to get money. Windows 10 nothing happens when i open exe. By tying their missions to their practices, such charities make any earned revenue related to their tax-exempt purpose and therefore avoid unwanted scrutiny from those seeking to challenge their charitable status.

Want to start your investing journey? Check out The Motley Fool's Broker Center and find the best broker for you.

This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular. Your input will help us help the world invest, better! Email us at knowledgecenter@fool.com. Thanks -- and Fool on!

Revenue as can be learned in more detail in the courseFinancial Literacy: Reading Financial Reports, is the total amount thathas been invoiced to customers over a certain period of time.It is very different from cash which isa step further when the customer has paid the invoice.It is the means to pay company expenditures and generate profits.It usually is the first priority of a company.As with no revenue, there is no money available to pay bills, salaries, orinvest in future growth.

While generating revenue is an important part of running a company,a high revenue number does not necessarily mean good performance.If that revenue does not lead to a profit, then you can question why inthe first place you put all the effort into generating that revenue.But still, a company needs revenue to survive, andtherefore, revenue analysis is a key element to managing business performance.There are different ways to analyze revenue,different angles to find solutions to different business problems.

Revenue is generated through customers that buy products or services.Through revenue analysis, we will be trying to analyze business growth.The objective will be to understand the underlying factors of business growth orbusiness decline.The main lenses through which we will be diving into revenue performance will befrom the customer angle, the product angle, the geographical angle, and so on.Reasons for revenue growth or decline can come from gaining new customers orlosing them or from current customers that buy more or fewer products and services.

In this course, you will learn where to find the data that makes upthe revenue of a company, how to prepare it foranalysis, and the key angles through which to analyze revenue.